Insurance Fundamentals Explained

Wiki Article

Insurance Fundamentals Explained

Table of ContentsThings about InsuranceSome Known Details About Insurance All About InsuranceNot known Details About Insurance Insurance for DummiesExcitement About Insurance

There are various insurance policy choices, and also numerous economic specialists will certainly state you require to have them all. It can be challenging to identify what insurance policy you truly require.Elements such as youngsters, age, lifestyle, and employment advantages contribute when you're constructing your insurance coverage profile. There are, nevertheless, 4 kinds of insurance coverage that most monetary experts advise all of us have: life, wellness, car, and lasting disability. 4 Sorts Of Insurance Coverage Everyone Requirements Life insurance policy The greatest advantages of life insurance policy consist of the ability to cover your funeral service expenses as well as offer those you leave behind - Insurance.

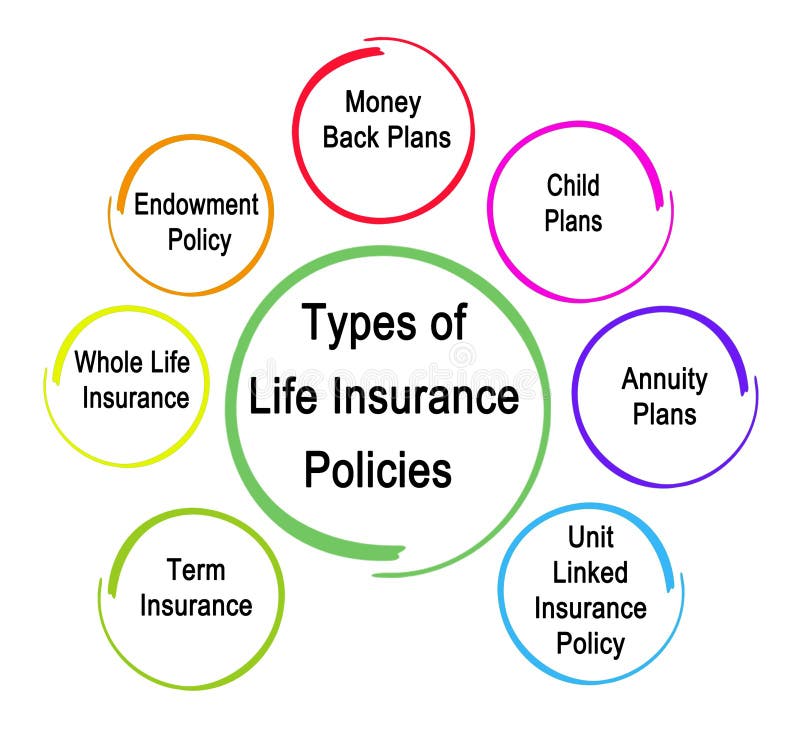

homes depend on double earnings. The research additionally discovered that a quarter of households would certainly experience economic challenge within one month of a wage income earner's death. Both fundamental kinds of life insurance policy are standard entire life as well as term life. Simply discussed, entire life can be made use of as a revenue device along with an insurance tool.

Some Ideas on Insurance You Need To Know

Term life, on the other hand, is a policy that covers you for a set quantity of time. Factors to think about include your age, occupation, and number of dependent kids.

, one in four workers going into the workforce will certainly end up being handicapped as well as will certainly be unable to function prior to they reach the age of retired life.

While medical insurance spends for hospitalization as well as medical bills, you're still entrusted to those everyday costs that your paycheck normally covers. Lots of employers provide both brief- and also long-lasting disability insurance coverage as part of their advantages package. This would be the best alternative for securing inexpensive disability insurance coverage. If your employer does not use lasting protection, here are some points to take into consideration before purchasing insurance on your own.

Unknown Facts About Insurance

25 million cops reported automobile crashes in the United States in 2020, according to the National Freeway Traffic Security Administration. An approximated 38,824 individuals died in car collisions in 2020 alone. According to the CDC, auto accidents are among the leading reasons of website link death around in the US and also around the globe.In 2019, financial costs of deadly automobile crashes in the US were around $56 billion. States that do call for insurance coverage conduct regular arbitrary checks of vehicle drivers for evidence of insurance.

Not known Factual Statements About Insurance

Once more, similar to official statement all insurance policy, your individual scenarios will figure out the cost of auto insurance. To make certain you obtain the ideal insurance policy for you, contrast numerous price quotes and the coverage given, and also examine regularly to see if you get approved for lower prices based upon your age, driving record, or the area where you live.

Whether you'll have insurance coverage when it does is one more matter entirely., not everyone recognizes the different kinds of insurance policy out there and also how they can help.

What Does Insurance Do?

Those with dependents In the event of fatality, a life insurance coverage plan pays a beneficiary an agreed-upon amount of cash to cover the expenses left by the deceased. A recipient is the person or entity named in a plan who obtains benefits, such as a spouse.Occupants Occupants insurance coverage is used by tenants to cover individual residential or commercial property in instance of damage or theft, which is not the responsibility of the proprietor. Make certain the cost of your airline tickets is covered in case of clinical emergency situations or various other incidents that may trigger a journey to be cut short.

Paying into family pet insurance coverage might be a lot more affordable than paying a round figure to your vet should your pet need emergency medical treatment, like an emergency clinic go to. Animal owners Pet dog insurance (mostly for pets as well as visit here cats) covers all or part of vet treatment when a family pet is harmed or sick.

The Only Guide to Insurance

Greater than 80% of uninsured participants who had an emergency either can not manage the costs or called for 6 or even more months to settle the bills. While Medicare and also Medicaid receivers were the least likely to need to spend for emergency situation costs, when they did, they were the least able to manage it out of the insured population.Report this wiki page